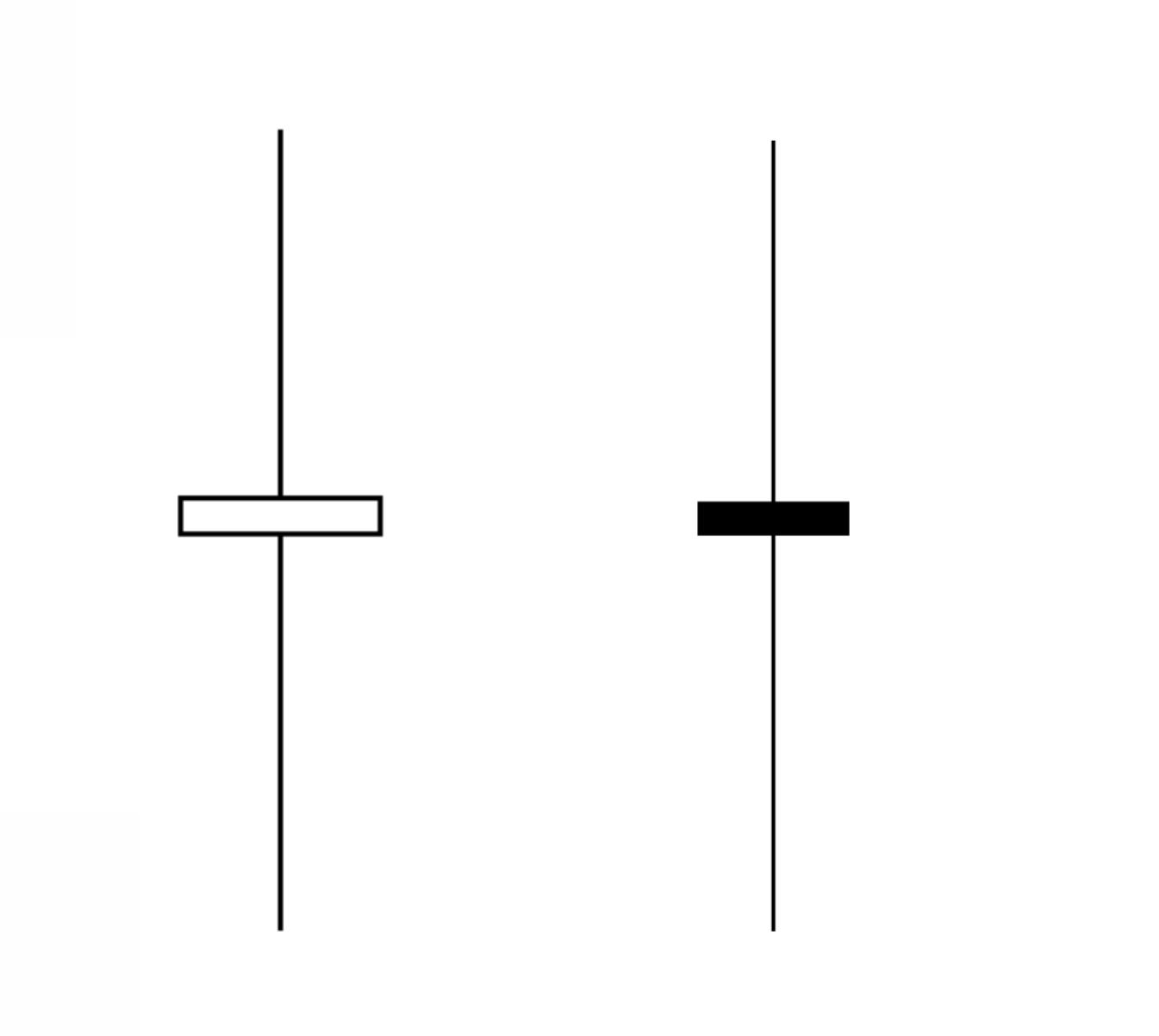

Long Legged Candlestick . A standard doji suggests moderate volatility and “quiet” market conditions. a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. The below image depicts how the pattern looks,

from www.newtraderu.com

The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. A standard doji suggests moderate volatility and “quiet” market conditions. a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The below image depicts how the pattern looks, The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session.

Rickshaw Man Doji (Long Legged Doji) Candlestick Patterns New Trader U

Long Legged Candlestick The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. A standard doji suggests moderate volatility and “quiet” market conditions. The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The below image depicts how the pattern looks,

From www.bestanalysis.in

Long Legged Doji Candlestick Pattern Best Analysis Long Legged Candlestick The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. The below image depicts how the pattern looks, a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The pattern forms in a volatile market with spiky price action and. Long Legged Candlestick.

From bullishbears.com

Long Legged Doji Candlestick What It Is, Indicates, and Examples Long Legged Candlestick a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The below image depicts how the pattern looks, A standard doji suggests moderate volatility and “quiet” market conditions. The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. The pattern. Long Legged Candlestick.

From www.newtraderu.com

Rickshaw Man Doji (Long Legged Doji) Candlestick Patterns New Trader U Long Legged Candlestick The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. A. Long Legged Candlestick.

From blog.joinfingrad.com

Mastering Long Legged Doji Candlestick Patterns Tips for Day Traders Long Legged Candlestick The below image depicts how the pattern looks, a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. A standard doji suggests moderate volatility and “quiet” market conditions. The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. The long legged. Long Legged Candlestick.

From trade180.com

Understanding the LongLegged Doji Candlestick Pattern Trade180 Long Legged Candlestick The below image depicts how the pattern looks, a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. A standard doji suggests moderate volatility and “quiet” market conditions. The long legged. Long Legged Candlestick.

From howtotrade.com

LongLegged Doji Candlestick Definition and Trading Example Long Legged Candlestick The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. A standard doji suggests moderate volatility and “quiet” market conditions. The below image depicts how the pattern looks, The long legged. Long Legged Candlestick.

From www.newtraderu.com

Long Legged Doji Candlestick Patterns Explained New Trader U Long Legged Candlestick The below image depicts how the pattern looks, a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. A standard doji suggests moderate volatility and “quiet” market conditions. The long legged. Long Legged Candlestick.

From tradingpdf.net

Long Legged Doji Candlestick Pattern [PDF Guide] Trading PDF Long Legged Candlestick A standard doji suggests moderate volatility and “quiet” market conditions. The below image depicts how the pattern looks, a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. The pattern. Long Legged Candlestick.

From investobull.com

What is Doji Candlestick Pattern? Long Legged Candlestick The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. The below image depicts how the pattern looks, A standard doji suggests moderate volatility and “quiet” market conditions. The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. a long. Long Legged Candlestick.

From www.tradingwithrayner.com

The Complete Guide to Doji Candlestick Pattern Long Legged Candlestick A standard doji suggests moderate volatility and “quiet” market conditions. The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. The below image depicts how the pattern looks, a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The long legged. Long Legged Candlestick.

From www.tradingwithrayner.com

The Complete Guide to Doji Candlestick Pattern Long Legged Candlestick A standard doji suggests moderate volatility and “quiet” market conditions. The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. The below image depicts how the pattern looks, The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. a long. Long Legged Candlestick.

From www.financialtechwiz.com

The LongLegged Doji Candlestick Pattern Explained Long Legged Candlestick The below image depicts how the pattern looks, a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. A standard doji suggests moderate volatility and “quiet” market conditions. The pattern. Long Legged Candlestick.

From howtotrade.com

LongLegged Doji Candlestick Definition and Trading Example Long Legged Candlestick a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. The below image depicts how the pattern looks, The pattern forms in a volatile market with spiky price action and. Long Legged Candlestick.

From www.youtube.com

How to work Long Legged Doji Candle All Single Candlestick patterns Long Legged Candlestick The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. A standard doji suggests moderate volatility and “quiet” market conditions. The below image depicts how the pattern looks, a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The long legged. Long Legged Candlestick.

From forexbee.co

Long legged Doji Candlestick A Trader's Guide ForexBee Long Legged Candlestick The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. The long legged doji has long upper and lower shadows, indicating that there was significant price movement during the period. A standard doji suggests moderate volatility and “quiet” market conditions. The below image depicts how the pattern looks, a long. Long Legged Candlestick.

From blog.joinfingrad.com

Mastering Long Legged Doji Candlestick Patterns Tips for Day Traders Long Legged Candlestick A standard doji suggests moderate volatility and “quiet” market conditions. a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. The long legged doji has long upper and lower shadows, indicating. Long Legged Candlestick.

From blog.premiumstoreco.com

The LongLegged Doji Trading the Right Candlestick Pattern Long Legged Candlestick a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. The below image depicts how the pattern looks, A standard doji suggests moderate volatility and “quiet” market conditions. The long legged. Long Legged Candlestick.

From blog.premiumstoreco.com

The LongLegged Doji Trading the Right Candlestick Pattern Long Legged Candlestick The pattern forms in a volatile market with spiky price action and signals market indecision during the trading session. a long legged doji is a type of doji candlestick pattern with longer wicks that indicate a price reversal. A standard doji suggests moderate volatility and “quiet” market conditions. The long legged doji has long upper and lower shadows, indicating. Long Legged Candlestick.